2025 Outlook: Gold & Precious Metals for Portfolio Diversification

The 2025 outlook for gold and precious metals suggests a pivotal role for these assets in portfolio diversification, offering a strategic hedge against inflation and economic volatility through a recommended 10% allocation.

As we approach 2025, the question of how to best secure and grow wealth becomes increasingly pertinent. Understanding the 2025 outlook for gold and precious metals: diversifying your portfolio with a 10% allocation is not just a strategic move; it could be an essential one for navigating the evolving economic landscape.

understanding the current economic climate

The global economic climate in recent years has been characterized by significant volatility, driven by geopolitical tensions, inflationary pressures, and shifting monetary policies. These factors create an environment where traditional investment strategies may face increased headwinds, prompting investors to seek more resilient assets.

Inflation, in particular, has emerged as a persistent concern, eroding purchasing power and devaluing conventional currency-denominated assets. Central banks worldwide are grappling with the delicate balance of controlling inflation without stifling economic growth, leading to an unpredictable interest rate environment. This uncertainty underscores the appeal of tangible assets like precious metals, which historically have maintained their value during periods of economic instability.

geopolitical influences on markets

Geopolitical events, from regional conflicts to international trade disputes, consistently introduce layers of complexity to financial markets. These events can trigger sudden shifts in investor sentiment, leading to rapid reallocations of capital. In such times, the safe-haven status of gold and other precious metals often comes to the forefront.

- Increased demand during crises: Investors typically flock to gold during periods of geopolitical unrest.

- Supply chain disruptions: Conflicts can impact mining operations and global distribution, affecting metal prices.

- Currency fluctuations: Geopolitical events often lead to currency devaluations, making gold more attractive.

In conclusion, the current economic climate, marked by inflation and geopolitical instability, creates a compelling case for re-evaluating traditional portfolio allocations. Understanding these underlying dynamics is the first step toward appreciating the strategic role of precious metals in a diversified investment strategy.

the historical role of gold in portfolios

Gold has long been revered as a store of value and a hedge against economic uncertainty, a reputation built over centuries of financial history. Its unique properties as a physical asset, coupled with its limited supply, have cemented its status as a reliable component of well-rounded investment portfolios, particularly during turbulent times.

Historically, gold has demonstrated a low correlation with other major asset classes such as stocks and bonds. This characteristic is precisely what makes it an effective diversifier. When equity markets experience downturns, gold often performs favorably, helping to cushion portfolio losses and preserve capital. This inverse relationship is a cornerstone of its appeal.

gold as an inflation hedge

One of gold’s most celebrated attributes is its ability to act as a hedge against inflation. When the cost of living rises and fiat currencies lose purchasing power, gold tends to hold its value or even appreciate. This is because gold cannot be printed or devalued by central bank policies, unlike paper money.

- Preserves purchasing power: Gold has historically maintained its value through inflationary periods.

- Limited supply: Its scarcity prevents artificial depreciation.

- Tangible asset: Provides a physical store of wealth immune to digital risks.

The historical performance of gold underscores its enduring value proposition. Its consistent ability to act as a safe haven and an inflation hedge makes it an indispensable asset for investors seeking to protect their wealth against economic shocks and currency debasement.

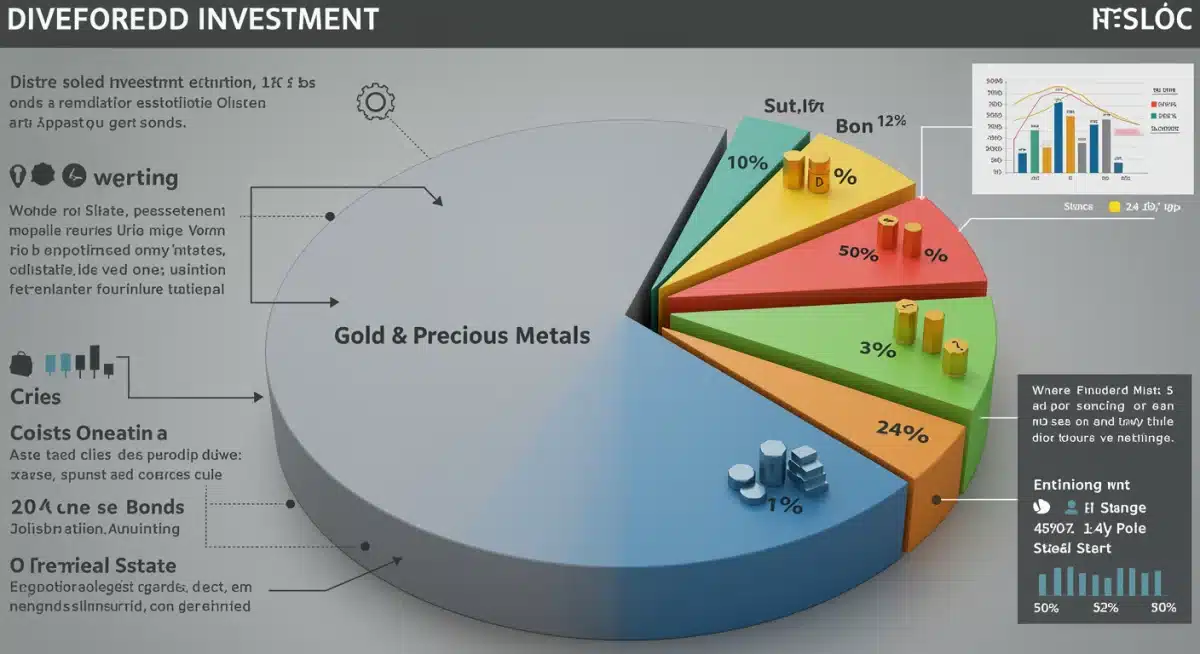

why a 10% allocation makes sense for 2025

Allocating approximately 10% of a portfolio to gold and precious metals for 2025 is not an arbitrary figure; it is a strategically informed decision based on historical performance, risk management principles, and the anticipated economic landscape. This allocation aims to strike a balance between capital preservation and growth potential, positioning investors for resilience.

A 10% allocation provides sufficient exposure to capture the benefits of precious metals during market downturns or inflationary spikes without over-concentrating the portfolio. It acknowledges gold’s role as a defensive asset while still allowing for significant exposure to growth-oriented investments like equities. This measured approach helps mitigate overall portfolio volatility.

balancing risk and return

The primary benefit of a 10% allocation is its effectiveness in balancing risk and return. By diversifying into assets that behave differently from traditional stocks and bonds, investors can reduce the overall risk profile of their portfolio without necessarily sacrificing returns. This strategy is particularly relevant in an unpredictable market.

- Reduced portfolio volatility: Gold’s low correlation helps stabilize overall returns.

- Enhanced downside protection: Acts as a buffer during market corrections.

- Optimized risk-adjusted returns: Improves the Sharpe ratio of the portfolio.

In essence, a 10% allocation to gold and precious metals is a prudent step towards building a more robust and adaptive investment portfolio for the challenges and opportunities that 2025 may bring. It’s about smart risk management.

beyond gold: other precious metals to consider

While gold often dominates discussions around precious metals, a diversified approach extends beyond this singular asset to include others like silver, platinum, and palladium. Each of these metals possesses unique industrial applications and market dynamics that can further enhance portfolio resilience and offer distinct investment opportunities.

Silver, often called ‘poor man’s gold’, shares many of gold’s safe-haven characteristics but also has significant industrial demand, making its price more volatile but also offering higher upside potential. Platinum and palladium, primarily industrial metals used in catalytic converters and other technologies, are sensitive to economic growth and supply chain disruptions.

the case for silver

Silver’s dual role as both a monetary metal and an industrial commodity offers a unique investment profile. Its increasing use in solar panels, electronics, and medical applications means that demand is often tied to technological advancements and global economic expansion. This industrial demand can provide a floor for its price, even during periods when investment demand for precious metals might wane.

- Industrial demand: Drives price movements based on economic activity.

- Affordable alternative: More accessible entry point for investors compared to gold.

- High volatility: Can offer greater capital appreciation during bull markets.

Considering a broader range of precious metals beyond just gold allows for a more comprehensive and robust diversification strategy. Each metal brings its own set of risk and reward factors, which, when combined, can create a more balanced and resilient portfolio.

strategies for integrating precious metals into your portfolio

Integrating precious metals into an investment portfolio requires careful consideration of various acquisition methods and storage solutions. The chosen strategy should align with an investor’s financial goals, risk tolerance, and liquidity needs. Understanding the options available is crucial for effective implementation.

Investors can gain exposure to precious metals through physical holdings, exchange-traded funds (ETFs), mining stocks, or futures contracts. Each method offers different levels of direct ownership, liquidity, and cost implications. Physical ownership, for instance, provides direct control but comes with storage and insurance considerations.

physical vs. paper assets

The debate between physical precious metals and paper assets (like ETFs or mining stocks) is a significant one. Physical gold and silver offer direct ownership and protection against systemic financial risks, as they are not subject to counterparty risk. However, they require secure storage and can be less liquid than their paper counterparts.

- Physical holdings: Direct ownership, protection against systemic risk, but require secure storage.

- ETFs: High liquidity, easy to trade, but involve counterparty risk and management fees.

- Mining stocks: Exposure to price movements of metals, potential for capital gains, but also company-specific risks.

Ultimately, the best strategy for integrating precious metals depends on individual circumstances. A balanced approach might involve a combination of physical holdings for long-term security and paper assets for liquidity and tactical trading opportunities.

potential risks and considerations

While the benefits of allocating to gold and precious metals are compelling, it is crucial to acknowledge the potential risks and important considerations associated with these investments. A thorough understanding of these factors ensures a balanced perspective and helps investors make informed decisions that align with their overall financial strategy.

Precious metals, like any other asset, are subject to market fluctuations. Their prices can be influenced by a multitude of factors, including interest rate changes, currency strength, geopolitical stability, and industrial demand. Therefore, while often considered a safe haven, their value is not immune to volatility.

market volatility and price swings

Despite their reputation for stability, precious metals can experience significant price swings. Factors such as shifts in investor sentiment, changes in global supply and demand, and speculative trading can lead to periods of high volatility. Investors must be prepared for these fluctuations and avoid making impulsive decisions based on short-term movements.

- Interest rate sensitivity: Higher interest rates can make non-yielding assets less attractive.

- Strong dollar impact: A stronger U.S. dollar typically makes dollar-denominated gold more expensive for international buyers.

- Liquidity concerns: In certain market conditions, selling physical precious metals quickly may be challenging.

Considering these risks and diligently researching the market are paramount. Diversification within the precious metals sector itself, by including different metals and investment vehicles, can also help mitigate some of these inherent risks. Always consult with a financial advisor to tailor your strategy.

| Key Point | Brief Description |

|---|---|

| Economic Volatility | Global uncertainties and inflation make traditional assets riskier, boosting precious metal appeal. |

| Gold as a Hedge | Historically, gold acts as a reliable hedge against inflation and market downturns. |

| 10% Allocation | A strategic allocation to balance risk, enhance stability, and protect purchasing power. |

| Beyond Gold | Consider silver, platinum, and palladium for broader diversification and industrial exposure. |

frequently asked questions

A 10% allocation is recommended for 2025 to provide a prudent balance of risk and return. It offers sufficient exposure to benefit from precious metals’ safe-haven properties during potential economic downturns and inflationary periods, without overly concentrating the portfolio in a single asset class.

Precious metals, particularly gold, act as an inflation hedge because they are tangible assets with finite supply and cannot be devalued by central bank money printing. When fiat currencies lose purchasing power due to inflation, the intrinsic value of gold tends to hold steady or even increase, preserving wealth.

Key risks include market volatility, as prices can fluctuate significantly due to economic data, interest rate changes, and geopolitical events. There’s also sensitivity to a strong U.S. dollar, which can make gold more expensive. Additionally, physical metals have storage and liquidity considerations.

While gold is a primary safe-haven asset, diversifying into other precious metals like silver, platinum, and palladium can offer additional benefits. Each has unique industrial demands and market dynamics, potentially enhancing overall portfolio resilience and tapping into different growth drivers.

Investors can gain exposure through various methods: purchasing physical bullion (coins or bars), investing in Exchange-Traded Funds (ETFs) backed by precious metals, buying stocks of mining companies, or engaging in futures contracts. Each method carries different levels of direct ownership, liquidity, and associated risks.

conclusion

The 2025 outlook for financial markets underscores the enduring importance of strategic portfolio diversification. Gold and precious metals continue to stand out as critical assets for navigating economic uncertainties, providing a robust hedge against inflation and market volatility. A carefully considered 10% allocation to these assets can serve as a cornerstone of a resilient investment strategy, offering both capital preservation and potential for growth in an unpredictable world. By understanding their historical performance, current market dynamics, and the various ways to integrate them into a portfolio, investors can make informed decisions to safeguard and enhance their wealth for the future.