2025 Crypto Regulations: U.S. Investor Compliance Guide

Understanding the latest 2025 trends in cryptocurrency regulations is paramount for U.S. investors to ensure compliance and navigate the complex, rapidly evolving digital asset market effectively.

As the digital asset landscape continues its rapid evolution, staying ahead of the latest 2025 trends in cryptocurrency regulations: what U.S. investors need to know to stay compliant becomes not just advisable, but essential. The regulatory environment surrounding cryptocurrencies in the United States is complex and ever-changing, with new guidelines and enforcement actions constantly shaping the future of digital finance. This article aims to demystify these critical developments, offering U.S. investors a clear roadmap to navigate the complexities and ensure their investments remain compliant and secure.

The Evolving Regulatory Landscape in 2025

The year 2025 marks a crucial period for cryptocurrency regulation in the U.S., with several key trends emerging that will significantly impact investors. Federal agencies, driven by concerns over consumer protection, financial stability, and illicit finance, are intensifying their efforts to establish a comprehensive framework. This includes clarifying the classification of various digital assets and expanding oversight to previously unregulated segments of the market.

One primary driver of this evolution is the increasing mainstream adoption of cryptocurrencies. As more institutional and retail investors enter the space, regulators are pressured to provide clearer rules of engagement. This push for clarity aims to foster innovation while simultaneously mitigating risks inherent in a decentralized financial system.

Key Legislative and Executive Actions

Several legislative proposals and executive orders from previous years are now maturing into actionable policies. These initiatives seek to harmonize the regulatory approaches of different agencies, creating a more unified stance on digital assets. Investors should pay close attention to bipartisan efforts in Congress that may lead to new laws defining the scope of digital asset securities and commodities.

- Clarity on Digital Asset Classification: Expect clearer guidelines from the SEC and CFTC on what constitutes a security versus a commodity, directly impacting how assets are traded and offered.

- Stablecoin Regulation: New frameworks are anticipated for stablecoins, focusing on reserves, auditing, and redemption mechanisms to ensure their stability and prevent systemic risk.

- DeFi Oversight: Regulators are exploring ways to bring decentralized finance (DeFi) protocols under existing or new regulatory umbrellas, addressing concerns about anonymous transactions and potential for market manipulation.

The convergence of technological advancements and governmental scrutiny means that the regulatory environment is becoming more sophisticated. Investors must adapt by staying informed and understanding how these changes will directly affect their portfolios and trading strategies. The goal for regulators is to build a robust system that protects investors without stifling the innovative potential of blockchain technology.

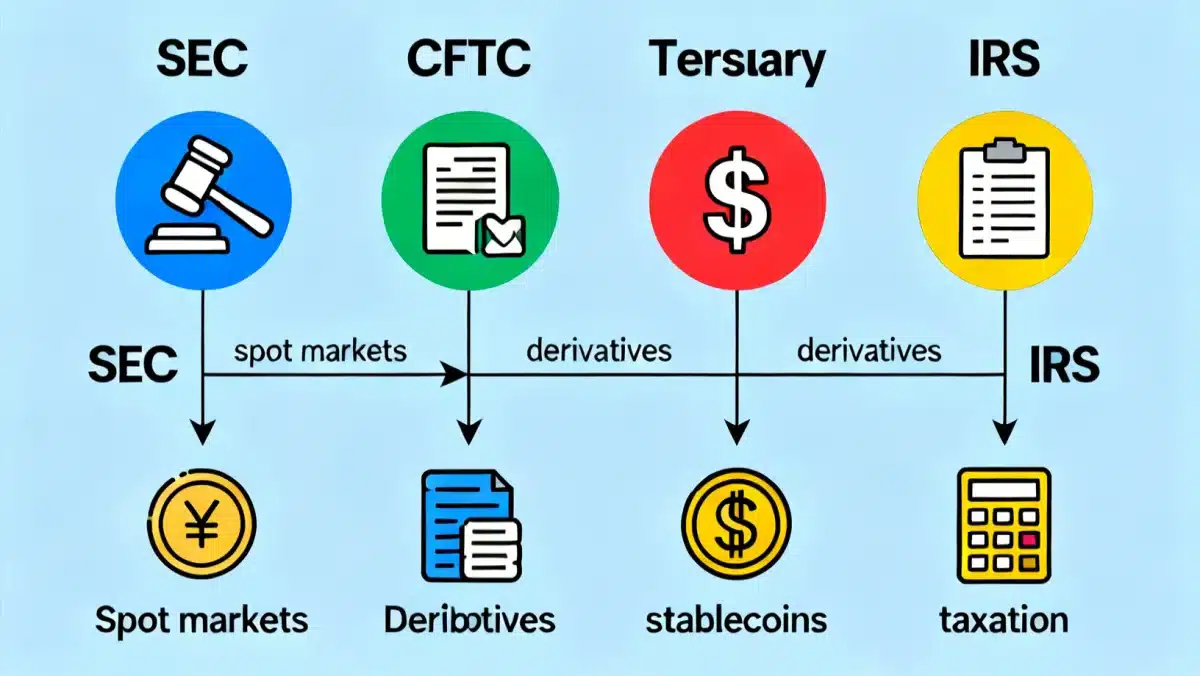

SEC and CFTC: Defining Digital Asset Boundaries

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) continue to be central figures in shaping U.S. cryptocurrency regulation. Their respective jurisdictions often overlap, leading to ongoing debates and legal challenges regarding which agency has ultimate authority over specific digital assets. In 2025, we anticipate further clarification, but also continued tension, as both agencies assert their roles.

The SEC, under its current leadership, maintains that many cryptocurrencies are unregistered securities, subjecting them to stringent disclosure requirements. This stance has led to numerous enforcement actions against projects and exchanges for alleged violations of securities laws. For investors, this means heightened scrutiny on how tokens are offered and traded on platforms.

Navigating the Howey Test and Beyond

The venerable Howey Test remains the SEC’s primary tool for determining whether a digital asset constitutes an investment contract and thus a security. However, 2025 may see new interpretations or even legislative updates that provide a more tailored framework for digital assets, moving beyond traditional definitions. This could introduce new criteria or thresholds for classification, affecting a wide range of tokens.

- Increased Enforcement Actions: Expect the SEC to continue its aggressive enforcement against projects and individuals deemed to be operating outside securities laws, particularly those involving initial coin offerings (ICOs) or unregistered exchanges.

- CFTC’s Expanded Role: The CFTC is likely to expand its oversight of digital asset commodity markets, including spot markets for major cryptocurrencies like Bitcoin and Ethereum, focusing on market integrity and preventing manipulation.

Investors must be diligent in researching the regulatory status of any digital asset they consider. Understanding whether a token is classified as a security or a commodity will dictate the applicable legal framework, reporting requirements, and potential risks. The distinctions between these classifications are not merely academic; they have profound practical implications for trading and holding digital assets.

Taxation and Reporting: IRS Focus Intensifies

The Internal Revenue Service (IRS) has consistently signaled its intent to close the “tax gap” related to cryptocurrency transactions. In 2025, U.S. investors should prepare for even more rigorous enforcement and clearer, potentially more complex, reporting requirements. The IRS views virtual currency as property for tax purposes, meaning capital gains and losses apply, along with income tax on certain activities like mining or staking rewards.

Advances in data analytics and information sharing between exchanges and the IRS mean that unreported crypto activities are becoming increasingly difficult to conceal. The agency is also likely to issue further guidance on nuanced tax situations, such as DeFi lending, NFT transactions, and airdrops, which have historically presented ambiguities for taxpayers.

Key Tax Compliance Measures for 2025

Staying compliant with IRS regulations requires meticulous record-keeping and an understanding of the various taxable events. Investors should be prepared for potential changes in reporting thresholds and the introduction of new forms or schedules specifically for digital assets. The emphasis will be on transparency and accurate disclosure.

- Form 1099-DA (Digital Asset): While not yet fully implemented, discussions around a dedicated form for digital asset reporting continue, which could streamline but also standardize reporting from exchanges and brokers.

- Expanded Broker Reporting: Exchanges and other crypto service providers are likely to face increased obligations to report customer transaction data directly to the IRS, similar to traditional financial institutions.

- Guidance on Specific Activities: Expect detailed guidance on the tax implications of activities like staking, yield farming, and various DeFi protocols, clarifying how these should be treated for income and capital gains purposes.

Proactive tax planning and the use of specialized crypto tax software are highly recommended. Consulting with a tax professional experienced in digital assets can help investors navigate these complexities and avoid costly penalties. The IRS is not just looking for major tax evaders; it’s also focusing on ensuring that all investors, regardless of the size of their holdings, comply with their tax obligations.

State-Level Regulations and Their Impact

While federal regulations often grab headlines, state-level initiatives also play a significant role in the U.S. cryptocurrency landscape. Some states have adopted progressive stances, aiming to attract blockchain businesses, while others have implemented stricter licensing and operational requirements. This patchwork of regulations can create additional compliance challenges for investors and businesses operating across state lines.

In 2025, we may see increased efforts to harmonize state regulations or, conversely, a deepening of divergent approaches. States like Wyoming have been pioneers in creating specific legal frameworks for digital assets, while others have focused more on consumer protection laws or money transmission licenses for crypto businesses. Understanding these varying state requirements is critical, especially for those engaging in peer-to-peer transactions or operating crypto-related businesses.

Key State-Level Considerations

Investors should be aware that their residence or the location of their chosen crypto service providers can impact the regulatory framework under which they operate. This means that a transaction legal in one state might face different scrutiny in another.

- Money Transmitter Licenses: Many states require businesses dealing with cryptocurrency to obtain money transmitter licenses, which can impose significant compliance burdens and affect the services available to residents.

- Blockchain-Friendly Legislation: Some states are enacting laws that provide legal clarity for smart contracts, digital property rights, and the use of blockchain technology in various sectors, potentially fostering innovation.

- Consumer Protection Laws: State attorneys general and financial regulators are increasingly focusing on consumer protection in the crypto space, addressing issues like scams, misleading advertising, and inadequate security measures.

For U.S. investors, navigating state-specific regulations often means selecting service providers that are licensed and compliant in all relevant jurisdictions. This adds another layer of due diligence to the investment process and underscores the importance of choosing reputable platforms and understanding their operational scope.

Anti-Money Laundering (AML) and Sanctions Compliance

Combating illicit finance remains a top priority for U.S. regulators, and cryptocurrencies are increasingly under the microscope for their potential use in money laundering, terrorist financing, and sanctions evasion. The Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) are spearheading efforts to enhance AML/CFT (Countering the Financing of Terrorism) compliance within the digital asset ecosystem.

In 2025, expect stricter enforcement of the Bank Secrecy Act (BSA) requirements for virtual asset service providers (VASPs), including exchanges, custodians, and even some DeFi protocols. This will likely involve enhanced customer due diligence (CDD), transaction monitoring, and suspicious activity reporting (SARs). For investors, this translates to more stringent identity verification processes and potential scrutiny of larger or unusual transactions.

Evolving AML/CFT Tools and Requirements

Regulators are pushing for technological solutions to track illicit flows and improve transparency in the crypto space. This includes the wider adoption of blockchain analytics tools and increased collaboration with international bodies to create a unified approach to AML/CFT in digital assets.

- Travel Rule Enforcement: The “Travel Rule,” which requires VASPs to share identifying information about senders and receivers for transactions above a certain threshold, is expected to see broader and more consistent enforcement.

- Sanctions Screening: Enhanced screening mechanisms will be required to ensure that transactions do not involve sanctioned entities or individuals, with severe penalties for non-compliance.

- DeFi and NFTs Under Scrutiny: Regulators are actively exploring how to apply AML/CFT rules to decentralized finance and non-fungible tokens (NFTs), recognizing their potential for illicit use.

U.S. investors should anticipate that compliant platforms will require more personal information and may temporarily freeze or flag transactions that raise red flags. Understanding these AML/CFT obligations is crucial, as participation in non-compliant activities, even unknowingly, can lead to severe legal consequences.

Protecting Investors: Consumer Safeguards and Education

Beyond regulatory frameworks for financial institutions, a significant focus in 2025 will be on direct investor protection and education. Given the volatility, complexity, and prevalence of scams in the crypto market, regulators are keen to empower investors with the knowledge and tools to make informed decisions and avoid potential pitfalls. This includes initiatives from the SEC, CFTC, and even the Consumer Financial Protection Bureau (CFPB).

There’s a growing recognition that traditional financial literacy campaigns may not adequately address the unique risks associated with digital assets. Therefore, expect to see more targeted educational resources and public awareness campaigns designed specifically for crypto investors, highlighting risks such as market manipulation, cybersecurity threats, and the irreversible nature of some transactions.

Key Investor Protection Initiatives

Regulators are exploring various mechanisms to safeguard retail investors, from stricter advertising rules for crypto products to enhanced disclosure requirements for platforms. The aim is to create a safer environment where innovation can thrive without compromising consumer trust.

- Enhanced Disclosure Requirements: Platforms offering crypto products are likely to face increased demands for clear, concise, and comprehensive disclosures about risks, fees, and operational models.

- Anti-Scam Campaigns: Government agencies will intensify efforts to educate the public about common crypto scams, such as phishing, rug pulls, and pump-and-dump schemes, and provide channels for reporting fraudulent activities.

- Custody and Security Standards: Discussions around mandatory custody standards for platforms holding customer digital assets are gaining traction, aiming to protect assets from hacks and insolvency.

For U.S. investors, this increased focus on protection means access to more reliable information and potentially safer trading environments. However, personal due diligence remains paramount. Always verify the legitimacy of projects and platforms, understand the underlying technology, and never invest more than you can afford to lose. Investor education is a shared responsibility between regulators and market participants.

| Key Regulatory Area | 2025 Investor Impact |

|---|---|

| Asset Classification | Clearer SEC/CFTC guidelines will define how assets are regulated, affecting trading and offerings. |

| Taxation & Reporting | Increased IRS scrutiny and stricter reporting for all crypto transactions. |

| AML/Sanctions | More stringent identity verification and transaction monitoring on platforms. |

| Investor Protection | Enhanced disclosures and educational efforts to mitigate risks and combat scams. |

Frequently Asked Questions About 2025 Crypto Regulations

New stablecoin regulations in 2025 will likely focus on ensuring reserves are fully backed and regularly audited. For investors, this could mean increased stability and transparency for stablecoins, potentially making them a safer asset for transactions and hedging, but also possibly leading to stricter exchange requirements.

U.S. crypto investors should anticipate increased IRS enforcement, clearer guidance on specific activities like DeFi and NFTs, and potentially new reporting forms. Meticulous record-keeping and understanding capital gains/losses on all transactions will be crucial to avoid penalties and ensure compliance.

Regulators are actively exploring how to apply existing or new rules to DeFi, focusing on consumer protection, AML/CFT, and financial stability. This could lead to requirements for identifying participants in some protocols or enhanced oversight of centralized components within DeFi, impacting anonymity and accessibility.

State-level regulations can significantly impact the availability of crypto services and compliance requirements based on an investor’s residence or chosen platform. Some states have specific licensing for crypto businesses, affecting operational scope and potentially adding layers of complexity to cross-state transactions or service provision.

To ensure compliance, U.S. investors should meticulously track all transactions for tax purposes, verify the regulatory status of assets and platforms, stay informed about legislative changes, and use reputable, regulated service providers. Consulting with legal and tax professionals specializing in crypto is also highly advisable.

Conclusion

The regulatory landscape for cryptocurrencies in the U.S. is undoubtedly dynamic, with 2025 poised to bring significant developments. For U.S. investors, staying compliant means more than just understanding the jargon; it requires proactive engagement with regulatory updates, diligent record-keeping, and a commitment to utilizing reputable and compliant platforms. While the challenges are real, a well-informed approach will enable investors to navigate new frameworks with confidence, mitigate risks, and continue participating in the transformative potential of digital assets. The ultimate goal for both regulators and investors should be a secure, transparent, and innovative digital financial ecosystem.